Paying Off the Federal Deficit

When I owned my Financial Planning/Money Management Firm, one of my long-term clients also became a good friend until he died. He was very successful in international business. After the US invasion of first Afghanistan and then Iraq, every time he came into the office he would go on a rant for a minimum of ten minutes about who is paying for wars. Then when that rant finished he started a new one about we should have a specific tax to pay for the wars.

The reality was no no one paid for the wars, the costs were kept off books which is a political way of saying the charged it by financing with deficit spending. At that time, the US had a Republican President and a Republican controlled Congress. I would suggest this is when the Republican Party really embraced their financial position as the Borrow and Spend Party. During that time period, Republicans cut taxes, increased spending. From a financial planning perspective decreasing and increasing spending income is a really bad economic policy.

A study by the Watson Institute of Brown University done in January 2020 estimated that unless paid down the interest of the war debt alone will be about $8 Trillion by 2050. I think it will be higher because I suspect interest rates will be higher.

The Federal Deficit was $5.7 Trillion when the second Bush become President. At the end of the first Trump Presidency it was $27.4 Trillion. Note, Republicans controlled the Presidency and Congress the majority of those years. According the National Debt Clock its now over $36.5 Trillion, the majority of the increase was accumulated during the Biden Presidency. For the record and the win, the last balanced budget was during the Clinton Presidency.

For perspective, again according the National Debt Clock the Federal Deficit per citizen is currently $107,000. This means that every baby is born has a personal debt of $107,000. For that matter every child 21 and under is in debt $107,000 and had nothing to do with creating it.

The average National Debt per tax payer is about $327,000

For more perspective, in 2023 the median household income in the US was about $81,000 and the median net worth $193,000. So the National Debt is 170% of the median household net worth.

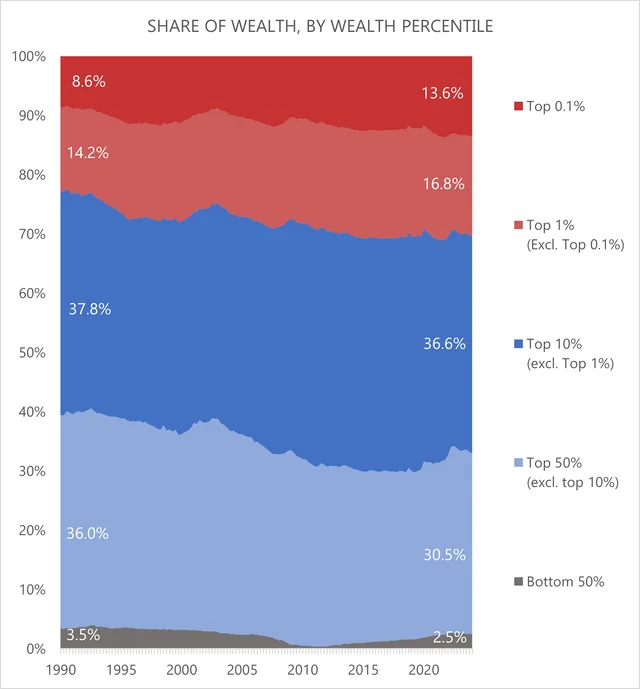

According to data from the Federal Reserve, the share of total US wealth owned by the top 0.1% increased from 8.6% to 13.6% from 1990 to 2024. The top 1% excluding the top 0.1% increased from 14.2% to 16.8%. The top 10% excluding the top 1% stayed about the same changing from 37.8% to 36.6%. The top 50% excluding the top 10% decreased from 36.0% to 30.5%. The bottom 50% share decreased from 3.5% to 2.5%.

One take away from the above is as the Federal Deficit increase, so did the wealth of the top 1%. I suspect some could make the case their wealth was in part accumulated from US deficit spending. A money transfer in a sense.

In dollars in the 3rd quarter 2024, the top 0.1% total wealth was about $22.1 Trillion. The next 9.99% was $27.1 Trillion. The rest of the top 10% minus the above two groups total wealth was $58.3 Trillion. This is almost 70% of our country’s wealth owned by a small percentage of the population.

A second take away, the only way to pay down on the deficit is to increase taxes on this group because they are the only ones who have a lot of money. And their wealth increase has been driven by American democracy, American economic growth and American deficit spending. I would suggest the very wealthy have benefited greatly from the increasing deficit, more than any other group.

I would suggest the increase in taxes should come in four different forms.

One an increase in marginal income tax rates. Remember after WWII, marginal tax rates during the Eisenhower Administration ranged from 91-92% and the country recovered from the War and had economic growth.

Two, increase the federal estate tax rate to 50% of taxable estate.

Three, cap the capital gains tax rate to the first 100,000 of gain in a calendar year. Gain after $100,000 would be taxed as ordinary income.

Four, eliminate the tax break for hedge funds and equity managers who often pay the capital gains tax rate on their earnings. All income in any form to hedge funds and equity managers would be taxed as ordinary income.

I am strong proponent of a balanced budget with any excess going to Federal Debt Reduction which as mentioned above has not happened since the Clinton era.

However, I suspect the Musk/Trump cuts in government spending will do considerable damage short and long term and not balance the budget. But even if Musk/Trump Republicans are able to balance the budget without raising taxes on the top 1%, it will not make any difference. The interest on the debt will eventually dominate the Federal Deficit. And if interest rates increase which I suspect is likely, the cost of the debt will increase at a faster rate.

I would suggest one reason that Musk gave almost $300,000 million to Republican candidates, the vast majority to Trump is he wanted to become the De Facto ruler of the US and he has done so. I would suggest the other reason is he and other very wealthy gave money to Trump and Republicans did not want to see their taxes increase, a Trump promise.

Again, I simply do not see another option for addressing the Federal Deficit without raising taxes on the very wealthy. I would suggest our country has a decision. Increase taxes on the wealthy or have our children and grandchildren deal with the fast increasing Federal Debt which they did not create.