Focus On What Will Affect Your Grandchildren

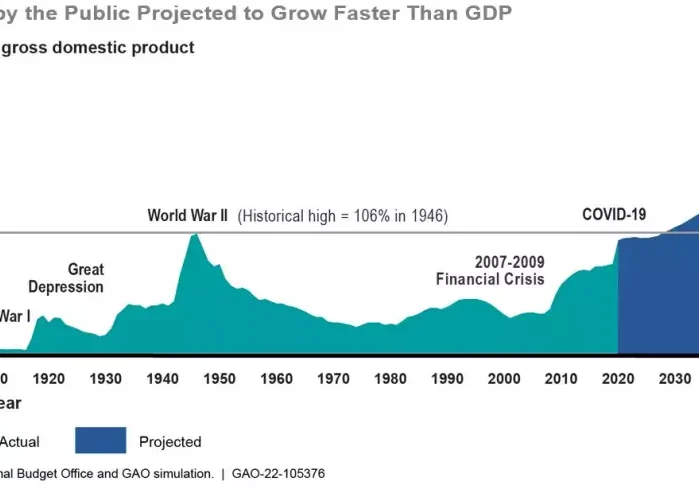

Anyone who knows me, knows I am a passionate [obnoxious] grandparent. For every minute I spend thinking about how politics, economics, social issues, and financial trends will affect me, I spend an hour thinking about how they will affect my grandchildren. I would challenge all grandparents to do the same. Not think in terms of next week or next year, but five, ten, and twenty years from now. The world is not the same as it was when we were growing up and never will be. This is not good or bad, just is. But decisions we make as grandparents today will affect our grandchildren throughout their entire lives. We can either help them as a generation, or make their lives more difficult. I choose to be advocate for my grandchildren until they can do so. The posts on this page will be about issues which I believe will affect our grandchildren.