GP Quiz, Federal Deficit or Screw the Grandkids

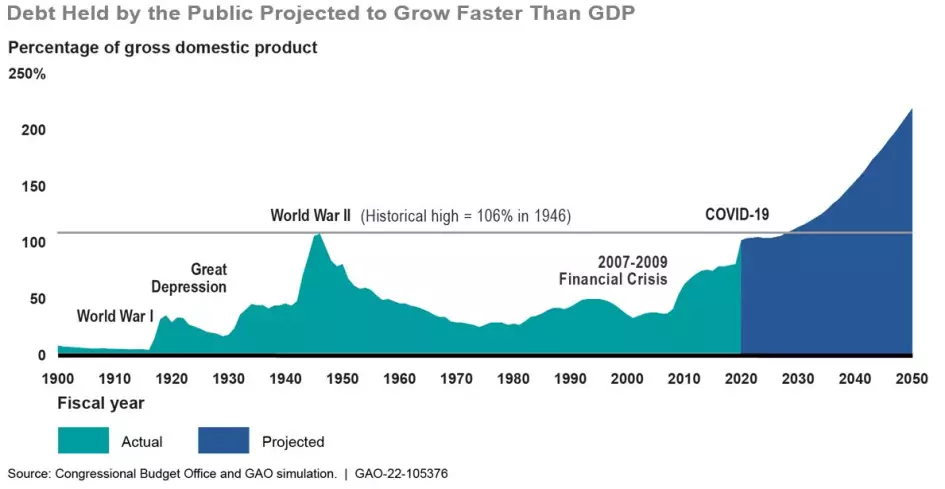

In 2020 the Federal Deficit was $5.7 Trillion. In 2020 at the end of the Trump Presidency it was $27.5 Trillion. The Federal Deficit went up almost $8 Trillion during the Trump presidency. Over the 20-year time period, the Federal Deficit increased by about $22 Trillion. Under the Biden Presidency with a split Congress the Federal Deficit has continued to increase to over $34 Trillion.

For the record, during the 20-year time period from 2000-2020, Republicans controlled the Presidency 12 of the 20 years, the House 14 of the 20 years and the Senate 10 years, with two years split. Anyone, who actually believes Republicans are more financially responsible, are either uniformed, naive, drink ten martinis a day or on a daily dosage of the funny weed. Maybe all of the above.

We have two political parties, Tax and Send or Borrow and Spend. And if that is the choices, and currently it is, Tax and Spend is better. Much Much Better.

Trump cut taxes and the Federal Deficit increased. Bush and Republicans cut taxes and started two wars which were primarily off the books. The reason was Republicans believed voters would support the war if did not affect their pocketbooks and reduced their taxes. This is literally insane. Increasing expenditures and decreasing revenue does not work for households and does not work for the Federal Government.

The real policy the last 20+ years is let’s get ours and screw the grandkids. I cannot tell you how many times over the past years I have heard one economist or another say the Deficit is not a problem today, but will be in the future. You think? This is just another way of saying FU Grandkids. Though both Democrats and Republicans bear responsibility, the Republicans bear much more because of their policy to increase Debt and cut taxes. In fact, for years Republicans signed a pledge to not increase taxes because some wealthy donor said [bribed] them to not do so.

Neither Democrats or Republicans will cut spending. They have shown no ability to do so in the last 20+ years. The only solution is to freeze spending and increase revenue. Increasing taxes on the lower and middle income will make no difference in revenue. But there are ways to raise revenues.

After WWII, the top marginal tax rate was 91%. That has gradually decreased to the current top rate of 37%. This strategy has not worked and the only answer is signifiant increases in the marginal tax rate.

Set a maximum for the amount of capital gains tax in a year with the excess becoming ordinary income.

Eliminate the tax breaks for private equity managers and hedge funds to name two so they are paying ordinary income tax on all their earnings.

Eliminate subsidies, guns and oil are two examples.

Increase the federal estate tax.

Most important, establish an asset tax starting at $10 Million dollars.

Note, it is vital the revenue from both the increased federal estate tax and potential asset tax be used solely to pay down on the deficit.

The reality is the top 1% of US households share of total US wealth has been gradually increasing for years with no benefit to the vast majority of Americans. All of the above have the potential to reduce this trend and reduce the National Deficit.

As an Independent Moderate, I will only support candidates who are willing to increase revenue in any or all of the above areas. For yours and my grandkids sake, I suggest you do the same. Remember, any grandchild born from 2000, each child’s share of the Federal Deficit is now over $100,000 and they have absolutely nothing to do with the increase in the Deficit since 2000. Neither have they received much if any benefit. We owe it our grandchildren to take a stand on their behalf today.